OUR TECHNOLOGY

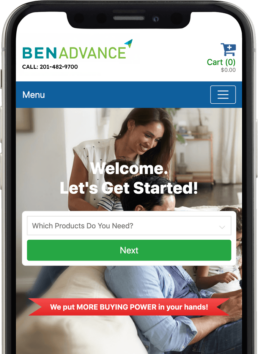

Your Platform

We created our platform to help insurance brokers and industry partners grow. The result is an intuitive shopping tool that allows individuals to shop and purchase high-demand supplemental insurance benefits.

Individuals can easily shop 24/7 – at the office or at home — with input from a significant other. Qualifying products can be purchased with pretax earnings deducted from payroll disbursement or ACH (direct employee bank withdrawal).

Brokers have a dashboard to view the activities of the employer groups and members they service. This includes product purchases and real time status of commissions earned.

Next-Gen Tech

FUTURE FORWARD

WHY BENADVANCE

BENADVANCE empowers you to serve as the comprehensive resource for insurance solutions, catering to clients ranging from individuals to any size groups.

Discover how BENADVANCE can significantly contribute to your business growth with minimal effort on your part. Explore our wide range of innovative, flexible products designed to meet the unique needs of your clientele.

BENADVANCE offers a no cost, turnkey solution to offer a comprehensive benefits package.

Product Portfolio

- Major Medical - Cigna, Anthem BCBS, and QualCare.

- Ancillary - dental, vision & life.

- Supplemental - Hospital Indemnity, Critical Illness, Accident.

How the plans are delivered

- Member self service website, brokerexchanges.com

- Comprehensive marketing - email, text, social media, newsletters and more…

EMPOWERING BROKERS

BENADVANCE

Broker Exchange Portal

Our client-centric approach ensures that individuals can conveniently arrange personalized one-on-one consultations with our dedicated benefits advisors for seamless medical enrollments.

Enjoy the freedom of enrolling year-round, as there are no constraints tied to open enrollment periods. With us, you have the flexibility and support you need to secure your medical coverage any time you require it.

WE HAVE YOU COVERED

Individual & Family Plans

Whether you’re seeking health insurance for yourself or your entire family, it’s crucial to find the right coverage. Our individual and family plans are designed to match with options that not only cater to your specific needs but also fit comfortably within your budget. By opting for our plans, you stand to save significantly on various healthcare services, including doctor’s visits, prescription drugs, and preventative care. Your well-being is our priority, and we’re dedicated to ensuring you receive the best healthcare without breaking the bank.

Small Business Plans

For small business owners, we offer specialized plans tailored to your unique needs. Check to see if your business is eligible for tax credits, which can help offset the costs of employee premiums, easing the financial burden. With our Individual Contribution Health Reimbursement Accounts (ICHRA), you can provide your employees with added flexibility, allowing them to manage their healthcare expenses more efficiently. What’s more, our inclusive approach ensures that all employees, including part-time staff, have the opportunity to participate. We go beyond traditional plans, aiming to give your employees a broader range of options, ensuring their well-being while considering your budget.

Dental Plans

Our dental plans are not only affordable, with potentially low monthly premiums, but they also offer extensive coverage to meet various dental care needs. From routine cleanings to fillings, our plans are designed to provide essential dental services, ensuring your oral health is well-maintained. Additionally, for those in need of more in-depth treatments, our plans may also cover more comprehensive procedures. We aim to offer a complete dental care solution that is both budget-friendly and comprehensive in its coverage

Vision Plans

Our vision plans are designed to prioritize your eye health and well-being. They potentially cover annual eye exams, ensuring that your eyesight is regularly monitored for any changes. Furthermore, for those who require corrective lenses, our plans may significantly reduce the cost of contact lenses or glasses, making vision correction more affordable. Beyond the basics, we understand the importance of comprehensive eye care, and our plans may also encompass coverage for more intricate procedures. We’re committed to offering a vision care solution that meets a broad range of needs while considering affordability.

Life Plans

We offer a guaranteed-approval life insurance with no waiting periods, providing immediate coverage up to $50,000. By answering three simple questions, coverage can be extended up to $300,000. Our process requires no medical exams or background checks, ensuring a swift and automatic approval on the guaranteed issue. For higher coverage limits, a limited underwriting is conducted, making the financial protection easily accessible with minimal delay.

We work with all the major carriers & more